The proportion of property investors active in the marketplace is back to its long-term average, comprising 34% of mortgage demand, based on the value of new mortgage commitments.

According to ABS lending indicators, at a state level NSW is receiving the bulk of the interest, with investors accounting for 38% of the value of new mortgage lending across the state.

At the other end of the scale, only 24.5% of mortgage commitments were for investment purposes across Tasmania and 28% in Western Australia.

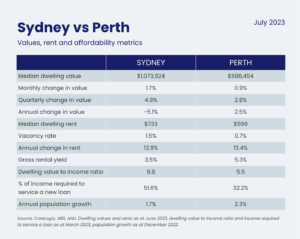

What really strikes me is that Western Australia, or Perth as the capital city, has one of the lowest portions of investment activity but the highest gross rental yields among the state capitals, at 4.9% and arguably some of the best prospects for capital gains.

Additionally, the entry point to the market is more achievable, with Perth home values recording the lowest median of the state capitals and prices are proving to be pretty resilient through the rate hiking cycle so far, in fact Perth is the only capital city where housing values have recovered to a new record high.

To me, the fundamentals suggest it is a location that presents one of the best investment opportunities around the country. And yet we’re not seeing investors very active in that marketplace.

Investors are more active in NSW where rental yields are the lowest of any state and in Sydney the lowest of any capital city. The buy-in price is significantly higher, and arguably the prospects for capital gains could be less significant when you consider the affordability challenges that remain apparent across the Sydney marketplace.

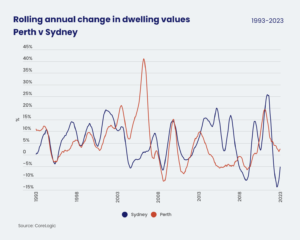

So, it’s hard to explain why investors seem to be less attracted to the Perth market. Perhaps there is a level of herd mentality playing out, where more investment is flowing into the Sydney or NSW market despite the unaffordability and low rental yields. Another reason why investor demand is weak may relate to the significant volatility in Western Australian housing values during and after the mining boom. After surging between 2004 and 2014, Perth home values plunged by 20% between 2014 and 2019 amid weak economic conditions.

The Perth market is a strong option for investors, as is southeast Queensland housing market, due to the strong fundamentals including higher yields, a lower buy-in price, and a rapid rate of population growth that is driven by a combination of overseas and interstate migration.

Both Western Australia and Queensland have a positive rate of interstate migration which better aligns to purchasing demand, as opposed to overseas migration that tends to be more aligned with rental demand.

Most of the population growth in NSW and Victoria stems from overseas migration, which will gradually flow into purchasing demand but it’s initially closely aligned with rental demand.

Property investors are often divided in their objectives. Most investors seem to focus on prospects for capital gains, while others will focus on opportunities to maximise their yield for cashflow.

If you’re looking for capital gain, well, sure Sydney and Melbourne do have a stronger history of capital gains, but they’re also relatively expensive which could dampen capital gain opportunities going forward.

If you’re looking for the best of both worlds, again, Perth and southeast Queensland have a higher yield profile but also, arguably, stronger prospects for capital gains, considering a healthy mix of housing demand from a blend of interstate and overseas migration, along with more affordable housing prices relative to the largest capitals.

Source https://www.corelogic.com.au/news-research/news/2023/east-or-west-australias-best-place-to-invest